Overview:

- Understanding Importance

- Creating a Budget

- Envelop System

- Dealing With Debt

- Savings Strategy

My journey of recovery has been paved with numerous lessons, but learning to manage my finances has been among the most transformative. The intersection of money and addiction recovery is fraught with challenges, yet mastering this aspect of life can lead to profound empowerment and stability. Today, I want to share some practical money management for recovering addict’s tips that helped me regain control over my finances and, by extension, my life.

The Importance of Money Management for Recovering Addicts

Firstly, understanding the significance of managing finances in addiction recovery is crucial. Substance abuse and poor money management often go hand-in-hand, leaving many in recovery with financial stress. Addressing these issues is vital because financial health can significantly affect mental and emotional well-being.

Creating a Budget

One of the first steps I took was to create a budget. This involved tracking my income and expenditures meticulously. It wasn’t just about limiting my spending; it was about understanding where my money was going and recognizing the difference between wants and needs.

The Envelope System

Adopting the envelope system was a game-changer for me. I allocated cash for different categories of expenses into separate envelopes. Once the cash in the envelope was gone, that was it for the month. It helped me avoid overspending and impulsivity—common traits that can linger from addictive behaviors.

Dealing With Debt

Addressing my debts was intimidating, but it was also liberating. I reached out to creditors to negotiate payment plans and interest rates. Getting debts under control was critical to relieve the financial pressures that could otherwise hinder my recovery.

Savings Strategy

I started a savings account specifically for emergencies. Having this safety net gave me peace of mind, which is priceless during recovery. It reduced my anxiety about unforeseen expenses that could otherwise derail my budgeting efforts.

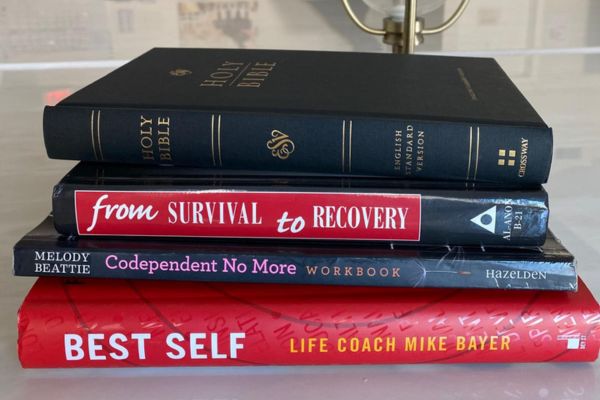

Investment in Education

Investing in my financial education was another step I took seriously. I read books, attended workshops, and utilized online resources to learn as much as I could about personal finance. Knowledge is power, and in this case, it was also the foundation of financial independence.

Cutting Costs

I looked for ways to cut unnecessary costs. Whether it was canceling unused subscriptions or opting for more cost-effective leisure activities, finding ways to save money became a rewarding puzzle to solve.

Earning More

Finding ways to increase my income played a role in my financial recovery. I took on part-time work, sold items I no longer needed, and used my skills to freelance. This not only boosted my income but also my self-esteem.

Mindful Spending

I learned to practice mindful spending. Before making a purchase, I would ask myself if it was necessary, if it contributed to my well-being, and if it aligned with my recovery goals. This mindfulness became a compass for my spending habits.

Seeking Professional Help

When needed, I didn’t hesitate to seek help from financial counselors. Professional advice helped me navigate the more complex aspects of finance, such as investing and retirement planning.

Giving Back

Finally, once my finances were stable, I started giving back. It was a way to express gratitude and to remind myself of the progress I’d made. Whether it was a small donation to a charity or buying a meal for someone in need, it reinforced the value of money as a tool for good.

Building a Stable Future

Money management for recovering addicts is about more than just dollars and cents; it’s about discipline, self-respect, and planning. In recovery, these are the pillars that not only support sobriety but also build a life filled with purpose and possibility.

If you’re navigating the path of recovery and grappling with financial challenges, know that you’re not alone. At Rising Lotus, we understand the complexities of recovery, including the aspect of financial health. Contact us at (866) 868-0014 to learn more about our recovery programs and how we can assist you in building a stable, fulfilling future, starting with solid money management skills. Together, we can create a plan that addresses your health, both financial and otherwise, setting you on a path to lasting wellness and success.